| VIEW ANOTHER STATE: |

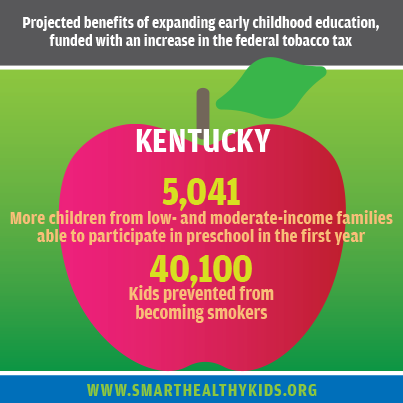

The proposal to expand high-quality early learning opportunities with a 94¢ increase in the federal cigarette tax would produce the following benefits in Kentucky.

Projected Benefits in Kentucky from Increased Federal Funding for Early Education

The proposed early learning initiative would benefit many Kentucky children who currently lack the opportunity to participate in high-quality preschool.

Currently, 16% of the state’s three-year-olds and 46% of the state’s four-year-olds are enrolled in publicly funded preschool (state preschool, preschool special education, or Head Start).

The initiative would initially focus on children in low- and moderate-income families. In Kentucky, 176,910 children under age six (53.7%) live in households with incomes below 200% of the federal poverty level.

The proposed early learning initiative could result in the following additional federal funding for and increased participation in preschool and voluntary home visiting in Kentucky in the first year alone:

| Additional funds provided to the state for preschool: | $41.30 million |

| Additional children from low- and moderate-income families able to participate in preschool: | 5,041 |

| Additional funds provided to the state for expanded voluntary home visiting program: | $7.90 million |

| Number of low-income women who give birth each year; these women and their children may benefit from voluntary home visiting: | 18,810 |

In subsequent years, the funding and the benefits will be even larger, because the national funding for the initiative is $75.00 billion over ten years for preschool, only $2.74 billion of which would be provided to states in the first year, and $15.00 billion over ten years for home visiting, only $433.40 million of which would be provided to states in the first year.

Projected Benefits in Kentucky from a 94-Cent Federal Cigarette Excise Tax Increase

Each year, smoking kills 7,800 Kentucky residents and costs the state $1.50 billion in health care expenditures. In addition, 21,900 of Kentucky youth try smoking for the first time each year. Increasing the federal excise tax on cigarettes would reduce the toll of tobacco in Kentucky, including the following public health benefits:

| Kids alive today prevented from becoming addicted adult smokers: | 40,100 |

| Current adult smokers who would quit in the first year: | 38,500 |

| Smoking-affected births avoided over the next 10 years: | 16,100 |

| Residents saved from future premature smoking-caused death: | 23,400 |

| 10-year health care cost savings from fewer smoking-caused lung cancer cases, heart attacks & strokes, and smoking-affected pregnancies & births: | $91.25 million |

| Long-term health care cost savings from adult and youth smoking declines: | $1.49 billion |

For more information including explanations and sources for the projections, see Appendices A and B.